2024 remodeling trends? A new sink instead of a new bathroom

___

Published Date 4/1/2024

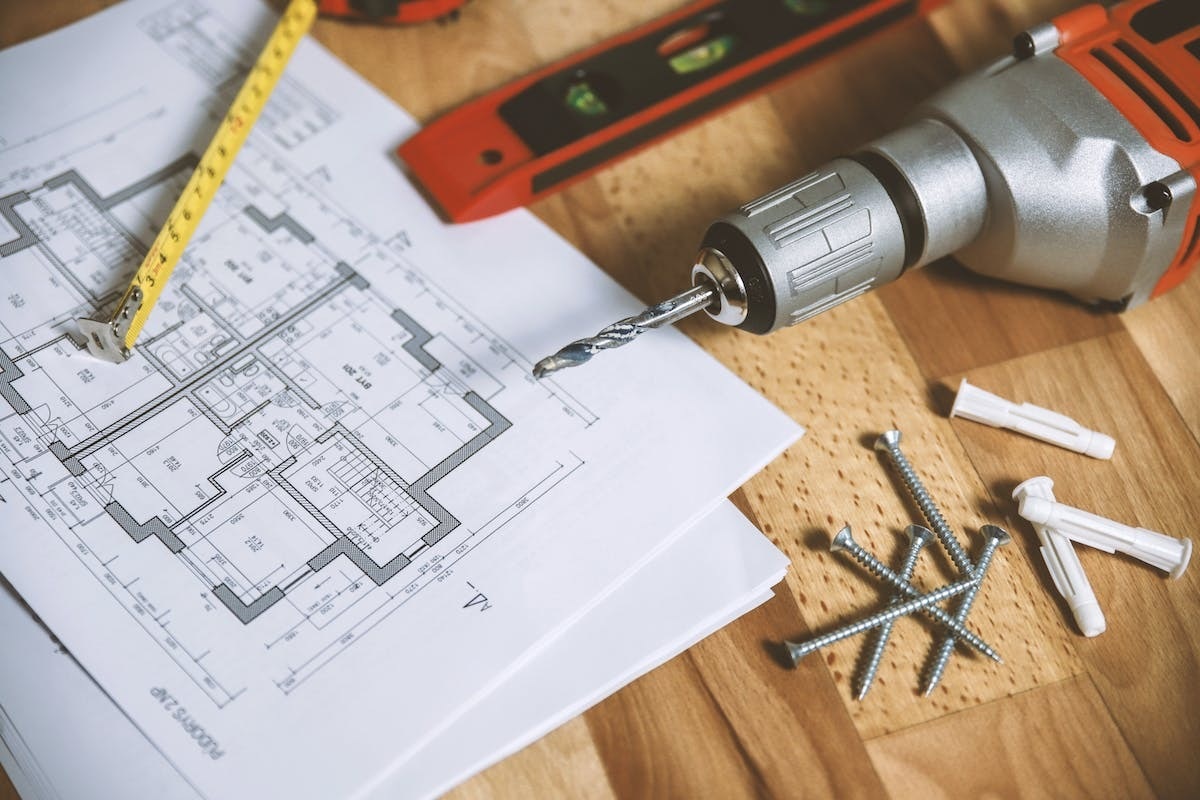

It was just a few years ago when mask-wearing homeowners lined up at the big box stores with everything from new sinks to lumber hanging off flatbed carts, and homes were being remodeled like crazy.

However NBC News’ Brian Cheung reports that households are currently hitting pause on their tub-to-shower conversion plans and buying new shower curtains instead.

“After a pandemic-era renovation craze, the nation’s two largest home improvement retailers say customers are spending less on big projects in favor of cheaper do-it-yourself fixes.” Says Cheung, who says shoppers are cutting back on kitchen and bathroom purchases and becoming more cautious about buying big-ticket appliances.

Lowe’s CEO Marvin Ellison told investors, “Those who did engage in home improvement activities took on smaller, non-discretionary projects with a heightened focus on value,” with sales dropping 6.2% compared to a year ago, which the retailer blamed on “persistent inflation and a stagnant housing market.”

Home Depot was among the brooding, with a 3.5% fourth quarter sales dip from the year before.

Lower cost improvements are still popular, however. Perhaps some new bathroom faucets instead of a new vanity. “Rising prices appear to be the main reason for consumers’ home renovation pullback,” says Cheung.

While the pace of consumer price increases has slowed dramatically, home improvement spending has been cooling for months, Lowe’s and Home Depot have said, after a frenzy to upgrade both newly purchased homes and those where people suddenly found themselves spending more time together during Covid lockdowns.

Today, many who may have counted on a cash-out refinance to streamline that 1996 kitchen don’t like the payments they are left with once they crunch those numbers.

But while the action has died down, households appear to be deferring, not ditching, their more ambitious renovation projects. Perhaps to the more “normal” pre-pandemic levels?

Big box stores reportedly expect many consumers to revisit their pricier plans later in 2024, when there will be pent-up demand that will bring opportunity for spending on larger home improvement projects as the economy improves.

Cheung asked Emmanuel Forge, a traveling contractor who posts home-renovation advice on TikTok if he’s had any trouble finding work lately. His response was no, but admitted that many homeowners underestimate how much projects cost, and some abandon their aspirations after doing the math.

“They didn’t imagine that a bathroom might cost 20, 30 grand to remodel,” Forge said. “They thought it might be five grand and a weekend or two.”

As 30-year fixed mortgage rates dipped below 3% in 2020, existing home sales soared to an adjusted annual peak rate of 6.6 million, according to the National Association of Realtors, reports Cheung. “Americans poured money into fixing up their properties at the same time. Comparable sales skyrocketed 29% at Lowe’s and 25% at Home Depot in the fourth quarter of 2020.”

When interest rates began to soar, however, would-be buyers held back. Fewer home sales means fewer homeowners looking to renovate. Pair that with the never-ending increase of materials costs, supply chain snags that are recovering now, and contractor wage increases and the picture gets clearer. The higher costs are one reason Forge said he could see homeowners opting not only for smaller projects but ones they can tackle on their own.

“Maybe instead of them buying $3,000 of cabinets to install themselves, they’re just going to paint them with $300 of paint,” he said.

NBCNews,TBWS

All information furnished has been forwarded to you and is provided by thetbwsgroup only for informational purposes. Forecasting shall be considered as events which may be expected but not guaranteed. Neither the forwarding party and/or company nor thetbwsgroup assume any responsibility to any person who relies on information or forecasting contained in this report and disclaims all liability in respect to decisions or actions, or lack thereof based on any or all of the contents of this report.

Licensed to do business in Washington & Oregon.

NMLS Consumer Access website: (www.nmlsconsumeraccess.org)

Bobbie Jo Haggard

Loan Officer / Mortgage Specialist

NMLS: #92472 - Washington & Oregon

Heartland Mortgage Inc.

30 S Palouse Street, Walla Walla WA 99362

Company NMLS: #3205

Office: 509-301-1661

Cell: 509-301-1661

Bobbie Jo Haggard

___

Loan Officer / Mortgage Specialist

NMLS: #92472 - Washington & Oregon

Cell: 509-301-1661

Last articles

___

Revisiting pandemic “boomtowns” - a study in staying power

5/1/2024

The shot heard ‘round the world was the boom many cities experienced during the ... view more

When a gambling addiction affects ‘home sweet home’

4/26/2024

It’s the nightmare we think only happens in the movies. “We have to pack,” says ... view more

Elegant decor updates need not break the bank

4/24/2024

Ever notice how some of the most elegant clothing and beautiful home decor have ... view more

March durable goods orders exceed expectations even as February’s orders revised significantly lower

4/24/2024

March durable goods orders expected +2.3%, increased 2.6% but February orders we... view more

Never underestimate the value of professional real estate agent representation

4/22/2024

Click the link; buy a sofa. Click on another; buy a pergola for your backyard...... view more

Lipstick on a pig? Some flips are a mess without their makeup

4/19/2024

Cosmetically all the hard work had already been done for them. What they didn’t ... view more

Rate cuts in 2024? There’s no ‘there there’ quite yet

4/15/2024

Inflation jumped in March, giving the U.S. Federal Reserve ammunition to hold of... view more

Three things that could impact rates this week

4/15/2024

These are the three areas that have the greatest ability to impact rates this we... view more

Load more

Heartland Mortgage Inc.

Heartland Mortgage Inc.