Initial Weekly Jobless claims lower than expected

___

Published Date 5/23/2024

Today's Mortgage Rate Summary

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up.

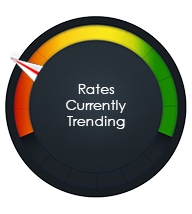

Rates Currently Trending: Higher

Mortgage rates are moving higher today. The MBS market worsened by -10 bps yesterday. This was not enough to increase mortgage rates or fees. The market experienced low volatility yesterday.

Today's Rate Forecast: Neutral

Housing: We will get April New Home Sales at 10 am ET.

Jobs: Initial Weekly Jobless Claims were lower than expected, Weekly Claims were 215K versus estimates of 220K. The four week moving average ticked up a smidge to 219K. Continuing Claims remained below 1.8M with at 1.794M reading.

The Fed: Today we will hear from Bostic again. The April Chicago Fed National Activity Index was dismal, contracting by -0.23. The prior month (March) was originally in positive territory with a reading of 0.15 but it was revised back into negative territory of -0.4.

Today's Potential Rate Volatility: High

This morning markets are moving towards higher rates. Volatility is high but should mellow some towards the end of the day.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.

Source: TBWSAll information furnished has been forwarded to you and is provided by thetbwsgroup only for informational purposes. Forecasting shall be considered as events which may be expected but not guaranteed. Neither the forwarding party and/or company nor thetbwsgroup assume any responsibility to any person who relies on information or forecasting contained in this report and disclaims all liability in respect to decisions or actions, or lack thereof based on any or all of the contents of this report.

“Equal Housing Lender. NEXA Mortgage, LLC NMLS 1660690. I am a licensed mortgage originator, NMLS # 630337, and licensed to originate mortgage loans in the state of AR, AZ, CA, NV, FL, GA, IL, MO, SC, TN, and TX. To learn more, visit my NEXA Mortgage website at https://lillianwong.net."

Lillian Wong

Mortgage Broker

NMLS: 630337

NEXA Mortgage

3100 W Ray Rd Ste 201, Chandler AZ 85226

Company NMLS: 1660690

Office: 480-650-5412

Cell: 480-650-5412

Email: lwong@nexamortgage.com

Lillian Wong

___

Mortgage Broker

NMLS: 630337

Cell: 480-650-5412

Last articles

___

The chicken or the egg? Buy or build?

11/8/2024

The decision to buy or build a home has become increasingly complex in today's m... view more

The bond market is calmer after several days of high volatility

11/8/2024

Yesterday Powell and the Fed lowered the FF rate by 25 bps as was widely anticip... view more

The Bank of England cut their key rate as was expected

11/7/2024

The Bank of England cut their interest rate by...... view more

When Your Neighbor's Mess Becomes Your Problem

11/6/2024

Curb appeal plays a crucial role when selling a home, with messy neighbors poten... view more

Markets under heavy pressure as inflation worries increase

11/6/2024

Inflation fears running rampant this morning...... view more

Balancing deductible and premium: Always a crap shoot

11/5/2024

Insurance is simply termed as the mitigation of risk. True, you pay, and pay, an... view more

The reported US trade deficit for September was higher than expected

11/5/2024

The September Goods and Services Trade Balance was $-84.4B versus estimates of.... view more

Housing Market Shift: Listings Soar to Pre-Pandemic Levels

11/4/2024

Even if home prices have not fallen, it might be good to know that you’ve got mo... view more

Load more

NEXA Mortgage

NEXA Mortgage