Dispelling a few myths if you think home ownership is out of reach

___

Published Date 9/1/2023

It’s easy to defeat the thought. You? Buy a home? “If that prospect sounds unlikely, we get it,” says Realtor.com’s Margaret Heidenry. “At first blush, becoming a homeowner may seem like a giant hurdle that’s impossible to get over financially and mentally.”

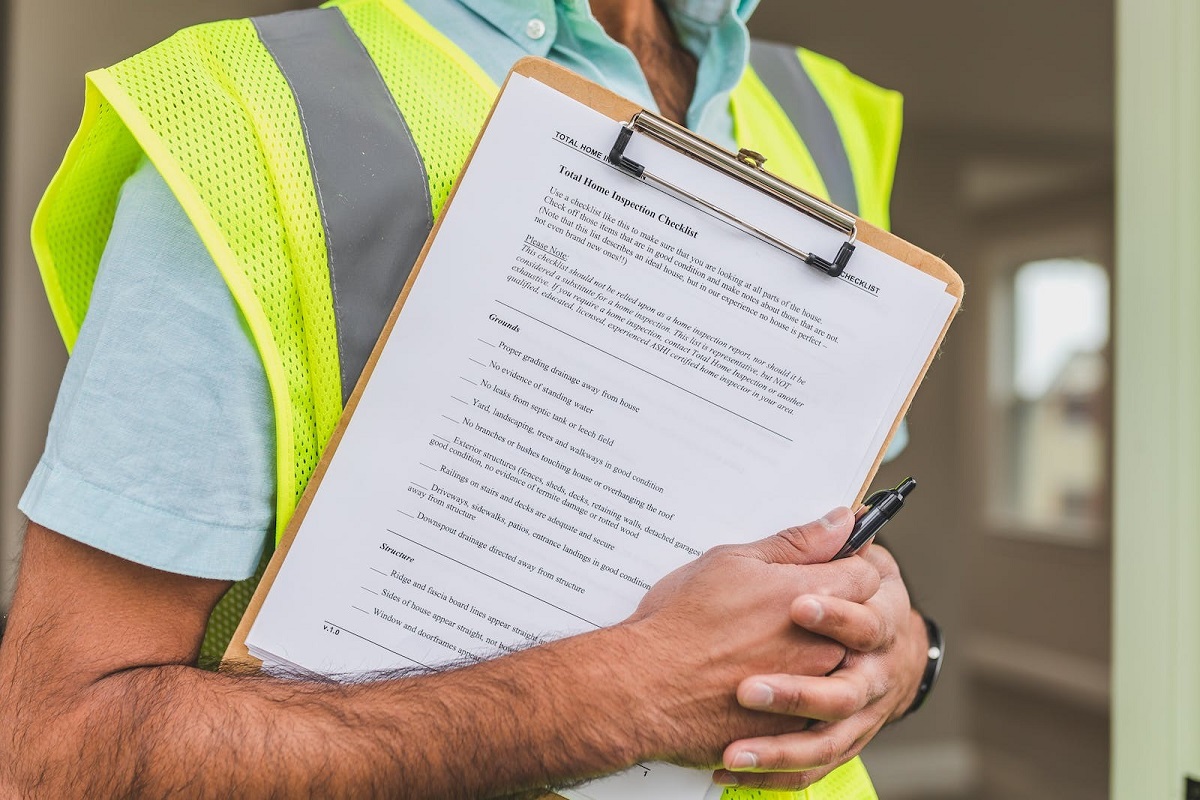

While amassing the funds and slogging through the necessary paperwork for your own piece of the real estate pie can be daunting, if you just assume there’s no way you could buy a home, without doing any research, you could be missing out. Heidenry cites some frequently given reasons people don’t buy a home as well as a few reality checks showing why they shouldn’t give up hope.

Probably the most common justification for not making the leap into homeownership is thinking you don’t have enough for a down payment. Few of us have a huge chunk of cash lying around, so the idea of coming up with 20% down to buy a home sounds like a bridge too far. But that’s a myth.

SmartAssets AJ Smith points out that with a loan backed by the Federal Housing Administration or Department of Veterans Affairs, you can usually get by with a down payment of 3% to 5%. Grants are also an excellent way for young buyers with good credit and stable employment to subsidize their down payment — typically obtained by taking homeownership courses or purchasing in designated community development areas. It’s important to keep in mind, however, that anything less than 20% will require private mortgage insurance, which can go away once you pass the 20% equity threshold.

Think you can’t afford a mortgage payment? If this is your excuse, test it out. Florida-based Realtor Kenneth Cagan says, “Some people don’t realize the amount they pay in rent is more than if they had a mortgage. Landlords are trying to recoup their taxes, insurance, and maintenance fees and still make a profit. When you buy, you’re investing in yourself.” Heidenry urges potential homeowners to use an online “rent vs. buy” calculator to see where they stand. And for first-time buyers with low to moderate incomes, there are also many first-time homebuyer programs to look into.

How is your credit report card? Just because you’ve made some late payments, or have other skeletons in your past that have dinged your credit score, it doesn’t put a mortgage out of reach. If you’ve paid down your credit cards and kept a steady job, your application may be approved. Even those with bad credit can also explore options such as lease-to-buy programs, financing through the seller, and loans from private lenders. A revelation? Some private mortgage insurance programs allow for credit scores as low as 620.

Meanwhile, you can slowly improve your credit score by paying your bills on time and keeping your balances and inquiries low. A licensed loan officer should be able to set up a one-year outline to get your credit on track. A word to the wise: mortgages for people with a lower credit score do come with a higher mortgage rate. And a very low score may require a higher down payment. So get your credit act together.

What if the problem isn’t bad credit, but no credit at all? There are ways to build credit history even without a credit card. If you rent, ask your landlord to report your payments to establish a history. Experian makes it easy for your landlord to report your payments, or for you to do it yourself.

While your work history is important as well, even if you recently changed jobs and have only been there for a month, you can get qualified depending on your income and field. A letter from your boss or place of employment can go a long way, so be sure to ask if you fear your relatively brief employment history might be an issue.

Realtor, TBWS

All information furnished has been forwarded to you and is provided by thetbwsgroup only for informational purposes. Forecasting shall be considered as events which may be expected but not guaranteed. Neither the forwarding party and/or company nor thetbwsgroup assume any responsibility to any person who relies on information or forecasting contained in this report and disclaims all liability in respect to decisions or actions, or lack thereof based on any or all of the contents of this report.

DISCLAIMER: Any interest rates and annual percentage rates (APRs) contained in this publication are based on current market conditions and are for informational purposes only.

Unlocked rates and APRs are subject to change without notice and may have pricing add-ons related to property type, loan amount, loan-to-value, credit score and other variables—call for

details. Progressive Lending Solutions, Inc. Licensed in MN and WI.

Progressive Lending Solutions, Inc

Corporate

NMLS: 107620

Progressive Lending Solutions, Inc.

Corporate: 2277 Hwy 36 W, Suite 304, Roseville MN

Company NMLS: 107620

Office: 866-680-2840

Cell: 612-940-5230

Email: info@progressivels.com

Progressive Lending Solutions, Inc

___

Corporate

NMLS: 107620

Cell: 612-940-5230

Last articles

___

Make yourself happy by dudding out your house with all you love

5/30/2024

Home is a place that reflects us. When it comes to decor that speaks to our soul... view more

Homebuyers need patience as well as a strategy

5/28/2024

In some instances, buying a home in today’s market amounts to a lot more than ma... view more

What aspects of buying can homebuyers actually control these days?

5/17/2024

This market. Call it what you will, because today’s homebuyers no doubt have all... view more

Put a cork in it. Why not?

5/7/2024

It may just be one of the best-kept secrets around when it comes to renovating o... view more

Downsizing after retirement: A decision best made with careful consideration

4/16/2024

Retirement can be a happy time. Earning downtime not steeped in paychecks and li... view more

The latest in real estate fraud: Forgeries expertly aided by computer technology

4/5/2024

This new huckster practice is known as deed fraud or home title theft. It involv... view more

Water in your home: Like water under the bridge or a cut above?

4/2/2024

When poet Samuel Coleridge was speaking of water being everywhere without a drop... view more

Great water pressure is no accident

3/26/2024

Water pressure is a big deal. Where we want it most, however, is in our homes, s... view more

Load more

Progressive Lending Solutions, Inc.

Progressive Lending Solutions, Inc.