Housing: A new kind of bubble we’ve never seen before

___

Published Date 1/24/2022

Round and round it goes. Where it ends, nobody knows. Or so that is the case with home values, which rose a whopping 17% in 2021 from the year before. First time homebuyers are being all but boxed out, with the average price for a home now sitting at $346,900.

For those entrenched under their own roofs, while it’s great to be giddy over how much their homes are now worth, the phenomenon can also bite them in the extremities if it’s their intention to sell and expect to buy a home at a fair price elsewhere.

"The price increase is a record," says Lawrence Yun, the chief economist for the National Association of Realtors, which just came out with the new numbers. He adds that the rise in home values is "even stronger than the days of subprime lending."

NPR’s Chris Arnold says Yun is referring to the ruinous lending practices that fueled the housing bubble and led to the financial crisis 15 years ago. Back then prices were getting artificially boosted because people were paying more than they could actually afford. “But Yun says reforms put in place by Congress since then ensure that people can afford the home loans they get. So something very different is happening now,” says Arnold.

"We are facing a major housing shortage," Yun says. "In December, we saw record low inventory, an all time low, there's simply not enough homes available for sale."

Working from home is no longer a novelty for many Americans, with millions of them looking for more space while bucking a record low supply, coupled with strong demand and high prices. But Yun expects price gains to moderate this year, perhaps to around 4% to 5%.

"The price gains will begin to normalize," he says. "And people should not anticipate another year of this double digit rate of appreciation."

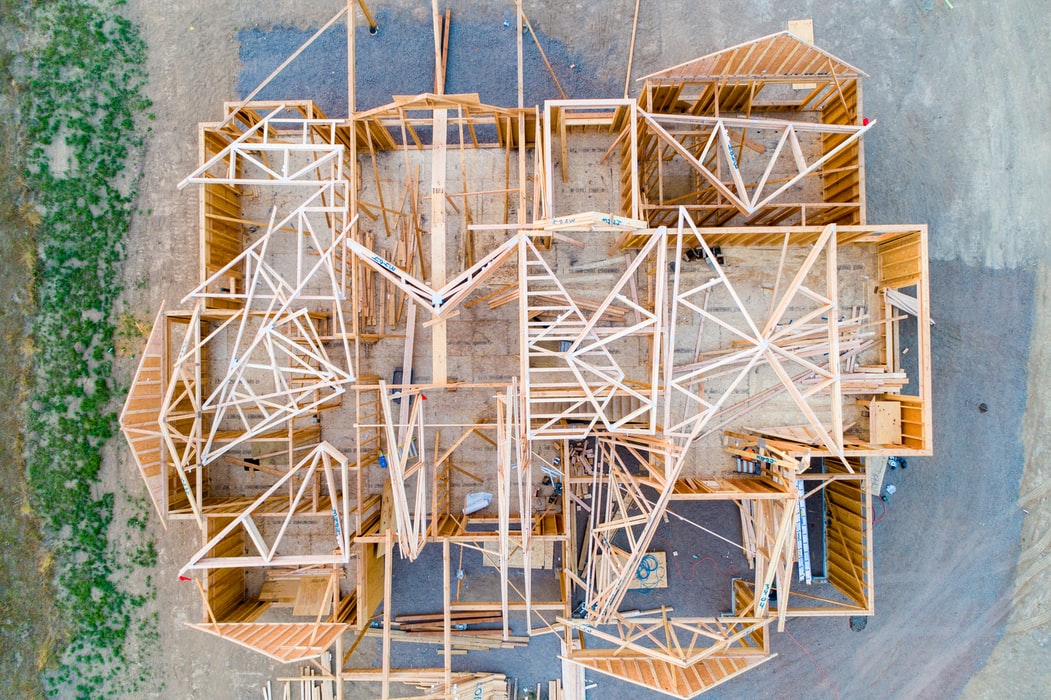

The law of supply and demand never truly goes out of style, however, and will continue to drive this real estate marketplace. Arnold says the housing market will remain out of balance so long as the supply of homes is so constricted. The reason? “After the financial crisis, many homebuilders went out of business, and for a decade the builders that were left did not build enough homes given population growth,” he says. “In fact, estimates are that the U.S. is short several million homes. And building more won't happen overnight.”

On the homebuilder front, there is no way to spin this. Builders say they are facing major headwinds including, in many places, a lack of available land, labor, building materials, and overly restrictive zoning.

"Policymakers could help by reducing lumber tariffs," says Robert Dietz, the chief economist of the National Association of Homebuilders. He says local and state governments could also help get more affordable homes built by, "enacting zoning reform to allow builders to build with greater density.” To top that off more workforce development programs are needed to train construction workers.

NPR, TBWS

All information furnished has been forwarded to you and is provided by thetbwsgroup only for informational purposes. Forecasting shall be considered as events which may be expected but not guaranteed. Neither the forwarding party and/or company nor thetbwsgroup assume any responsibility to any person who relies on information or forecasting contained in this report and disclaims all liability in respect to decisions or actions, or lack thereof based on any or all of the contents of this report.

Superior Funding Corporation is a Massachusetts Mortgage Company. Massachusetts Mortgage Lender and Broker License: MC2972, NMLS ID: 2972.

Roman Shulman

Mortgage Professional

NMLS: 11481

Superior Funding Corporation

343 Washington Street, Newton MA

Company NMLS: 2972

Office: 617-938-3900

Email: rshulman@sfcorp.net

Web: http://sfcorp.net

Roman Shulman

___

Mortgage Professional

NMLS: 11481

Last articles

___

March durable goods orders exceed expectations even as February’s orders revised significantly lower

4/24/2024

March durable goods orders expected +2.3%, increased 2.6% but February orders we... view more

Never underestimate the value of professional real estate agent representation

4/22/2024

Click the link; buy a sofa. Click on another; buy a pergola for your backyard...... view more

Markets see a minor rebound

4/17/2024

Overnight a little volatility but well within the narrow range, the 10 year note... view more

Rate cuts in 2024? There’s no ‘there there’ quite yet

4/15/2024

Inflation jumped in March, giving the U.S. Federal Reserve ammunition to hold of... view more

Markets experience major setback on higher than expected CPI

4/10/2024

The day the world awaited, March CPI. Prior to the 8:30 am ET release the 10 yea... view more

Contradiction of robust job growth and a sluggish housing market isn’t over yet

4/8/2024

For the past few years, fears of a recession have been fickle, teasing us at eve... view more

The ADP Private Jobs report was much stronger than expected

4/3/2024

US financial markets continue to reel over the concerns the Fed may withhold the... view more

2024 remodeling trends? A new sink instead of a new bathroom

4/1/2024

It was just a few years ago when mask-wearing homeowners lined up at the big box... view more

Volatility remains low

3/27/2024

Markets started the day fractionally better, the 10 year note at 8 am ET 4.22% -... view more

NAR settlement may mean commission rebates if you recently sold your home

3/25/2024

While agents are still sorting out what all this means for their business, the m... view more

Load more

Superior Funding Corporation

Superior Funding Corporation