___

Published Date 2/5/2024

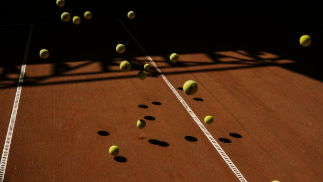

. Follow the bouncing ball. Those old enough to know what that means (an outrageously popular 1960s sing-along TV show) have probably lived in all the homes they intend to have owned. Those who don’t wonder whether the 2024 housing is just bouncing back and forth, leaving them uncertain. According to a recent Realtor.com report and Margaret Heidenry, there have been some signs of housing inventory recovering, with the number of homes actively for sale growing by 7.9% year over year in January, That’s “notably higher compared to last year,” according to Realtor.com Chief Economist Danielle Hale. Add to that the fact that mortgage rates have also subsided from their 23-year high, and you’d think the ball is going in the right direction. Despite this double dose of promising news, however, Hale doesn’t expect that America’s housing affordability crisis will improve all that quickly. She predicts it will take a few baby steps forward, and maybe one or two back. “While gradually falling mortgage rates are helping slow the cost to purchase a home, the housing market will likely bounce back and forth between improvement and status quo over the next several months,” she explains. And then there is the pre-and-post-pandemic number for just about everything, right? While housing inventory may be up annually, it is still down compared with typical pre-pandemic levels from 2017 to 2019 by a whopping 39.7%. So it’s all relative. The Fed seems happier but is not yet convinced we are safe — in part because its battle against inflation is not yet over. Don’t forget that it raised interest rates to bring inflation down. And while it doesn’t set mortgage rates, mortgage rates generally follow the same trajectory as the Fed’s short-term interest rates. Reach out for more! Realtor, TBWSAll information furnished has been forwarded to you and is provided by thetbwsgroup only for informational purposes. Forecasting shall be considered as events which may be expected but not guaranteed. Neither the forwarding party and/or company nor thetbwsgroup assume any responsibility to any person who relies on information or forecasting contained in this report and disclaims all liability in respect to decisions or actions, or lack thereof based on any or all of the contents of this report.

Bank statement for Self Employed are our Specialty! JUMBO LOANS at Amazing rates!

Jacqueline Barikhan

Loan Officer

NMLS: 914312

Jackie Barikhan - Summit Lending

15183 Springdale St, Huntington Beach, CA CA 92649

Company NMLS: 914312

Office: 949-855-0760

Cell: 949-600-0944

Email: jackie@mylenderjackie.com

Jacqueline Barikhan

___

Loan Officer

NMLS: 914312

Cell: 949-600-0944

Last articles

___

Proposed legislation may have no effect on home prices

5/13/2024

The drive to bring down-home prices is not going well...... view more

Three things that could impact rates this week

5/13/2024

These are the three areas that have the greatest ability to impact rates this we... view more

Offloading the family ‘estate’ can be a challenge

5/10/2024

The inherited home. Sometimes it’s in a great neighborhood, but often it’s not a... view more

Consumer sentiment declines in latest reports

5/10/2024

The economy, based on a couple of recent reports, is slowing. Both the Conferenc... view more

Markets calm despite rise in Initial Weekly Jobless Claims

5/9/2024

Initial Weekly Jobless Claims were higher than expected, up 231K versus estimate... view more

Having a house of green is easier than ever

5/8/2024

Anyone can paint a house green, but how many people have a greenhouse on their p... view more

Shaking loose a stagnant real estate market might take drastic measures

5/6/2024

What goes up must come down? High in the sky home prices now seem like a hot air... view more

Three things that could impact rates this week

5/6/2024

These are the three areas that have the greatest ability to impact rates this we... view more

Load more

Jackie Barikhan - Summit Lending

Jackie Barikhan - Summit Lending